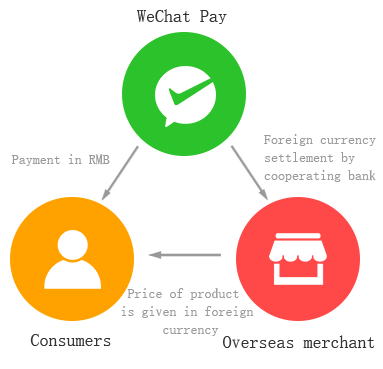

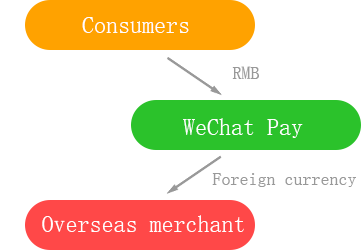

Four modes of payment

1、Paying using merchant’s fixed QR code

Customer scans QR code using WeChat

Customer inputs payment sum, e.g. $0.10 AUD, equivalent to ¥0.53 RMB at time of exchange

Customer enters payment password and RMB is automatically deducted from the customer’s account

Payment is complete, and both the customer and merchant receive reminder notifications

2、Paying using WeChat Pay on a web page

-

Customer selects desired purchase in-store

-

During payment, customer selects “WeChat Pay”

-

Merchant’s payment QR code is displayed, customer scans it using WeChat, and the payment is complete

3、Paying using a point of sale terminal

Merchant enters amount to be charged in an OmiPay point of sale terminal

Merchant selects “WeChat Pay”

Merchant scans customer’s WeChat QR code

System automatically deducts RMB from the customer’s account according to the current exchange rate, payment is complete and terminal prints out a receipt

4、ashier system for retail terminals (no need to change ERP system)

-

Merchant confirms amount to be charged on point of sale terminal

-

Merchant uses barcode scanner to scan customer’s WeChat or Alipay payment code. Software automatically identifies payment code;Software automatically identifies amount to be charged by the point of sale system ;Payment field is displayed

-

Click to confirm receipt, and payment is complete

5、Paying with QR code printed on receipt (no need to change ERP system)

Cashier installs OmiPay plug-in

Customer scans QR code

Customer enters password

Payment is complete